Within today's rapidly evolving economic landscape, the significance of technology in trading has become more critical. As markets develop and increase in sophistication, traders are utilizing sophisticated software tools to gain a strategic edge. The integration of software into trading strategies is changing how investors obtain information, examine data, and perform trades, making it crucial for both novice and seasoned traders to adopt these advancements.

The advantages of using software tools for trading go far beyond mere convenience. A carefully constructed trading system can simplify the usually daunting process of market analysis, permitting traders to discover advantageous opportunities with higher precision and efficiency. From Tradesoft -driven trading algorithms to sophisticated analytical platforms, these tools provide invaluable insights that can improve decision-making and ultimately lead to trading success. By harnessing the capability of software, traders can navigate the intricate world of financial markets with confidence and accuracy.

Understanding Market Systems

A market strategy is a group of guidelines and procedures that guide traders in making decisions about acquiring and disposing of assets. These systems can be based on a variety of factors, including technical indicators, market trends, and fundamental analysis. The goal is to provide a organized approach to trading that can help reduce emotional choices and enhance overall results in the markets.

Contemporary trading strategies often leverage sophisticated technological tools that streamline various aspects of the trading process. This includes generating alerts for trades, managing risk, and carrying out transactions at favorable prices. By utilizing these systems, traders can exploit trading opportunities more quickly and with greater efficiency than traditional trading methods would allow.

Additionally, a well-designed trading system can be evaluated against historical data to assess its performance. This testing can provide traders insights into potential profitability and risks associated with their strategies before investing real capital. As a consequence, trading systems can not only improve the decision-making process but also foster confidence, making them a important asset for both beginner and seasoned traders alike.

Essential Trading Software Attributes for Success

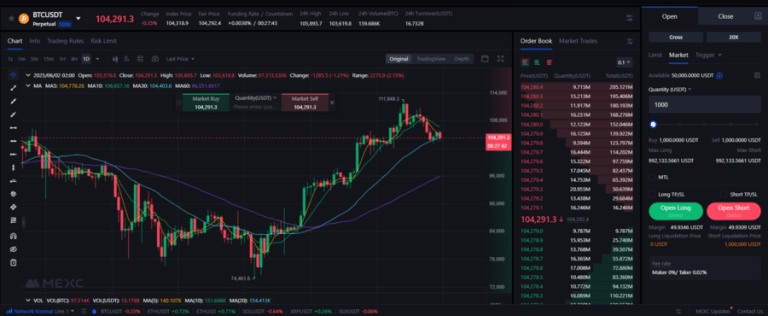

As you are choosing trading tools in trading, it is vital to concentrate on functions that improve the decision-making process and improve execution. An efficient trading system should incorporate immediate data analysis capabilities, allowing traders to monitor market movements promptly. This capability enables users to respond swiftly to market changes, making informed decisions based on up-to-date information. Furthermore, customizable dashboards can help traders customize their viewing experience to concentrate on key metrics that are most relevant to their trading strategies.

Automation is another crucial aspect of successful trading tools. With trading automation capabilities, traders can establish fixed criteria for opening and exiting positions, which limits subjective decision-making. This automated approach can operate based on predefined rules that analyze market situations, executing trades when specific thresholds are met. Such features not only save time but also ensure consistency in trading practices, which is crucial for long-term success.

In conclusion, strong risk management tools are critical for safeguarding capital. A reliable trading platform should provide features such as stop loss orders and position sizing calculators. These tools help traders manage their exposure and secure profits by systematically limiting possible losses. By utilizing these sophisticated functionalities, traders can enhance their overall results while minimizing risks associated with market volatility.

Implementing and Improving Your Approach

After you have decided on your trading strategy, the next step is implementation. This involves incorporating the system into your trading routine. Start by defining your trading goals and risk guidelines. It is essential to familiarize yourself with the capabilities to maximize its effectiveness. Make sure to establish criteria that align with your trading style, whether that involves intraday trading, swing trading, or long-term investing.

After implementation, enhancement becomes vital for ensuring a competitive edge. Regularly review the performance of your trading system by examining data and market trends. Adjust your tactics based on insights acquired from your past trades. Using historical analysis tools can facilitate replicate trades based on historical data, allowing you to fine-tune your strategy without putting at stake your investment.

Ongoing education is crucial in the constantly changing trading environment. Stay updated with new software features, economic indicators, and strategies. Engage with the trading community through forums or social platforms to exchange insights. By continually improving your approach and adapting to shifts, you will boost your trading success and create sustainable profits.